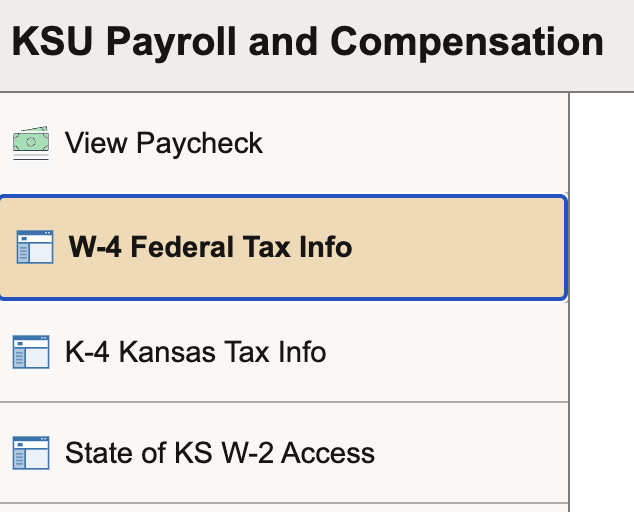

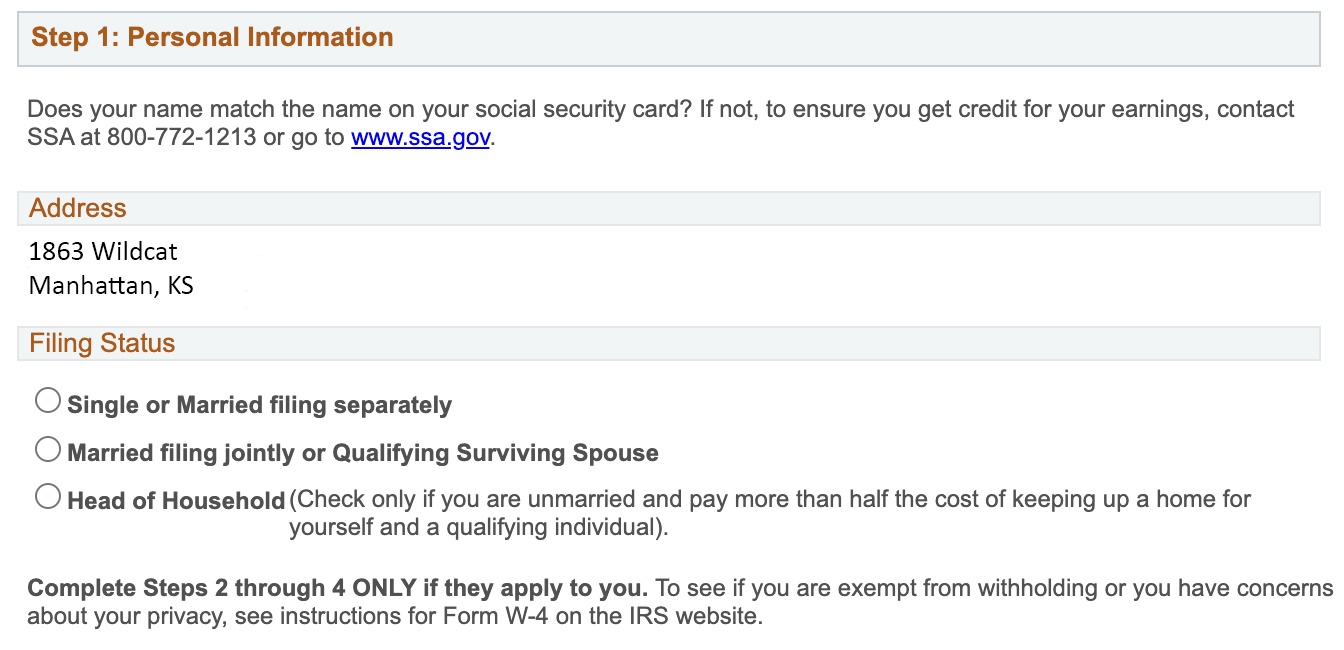

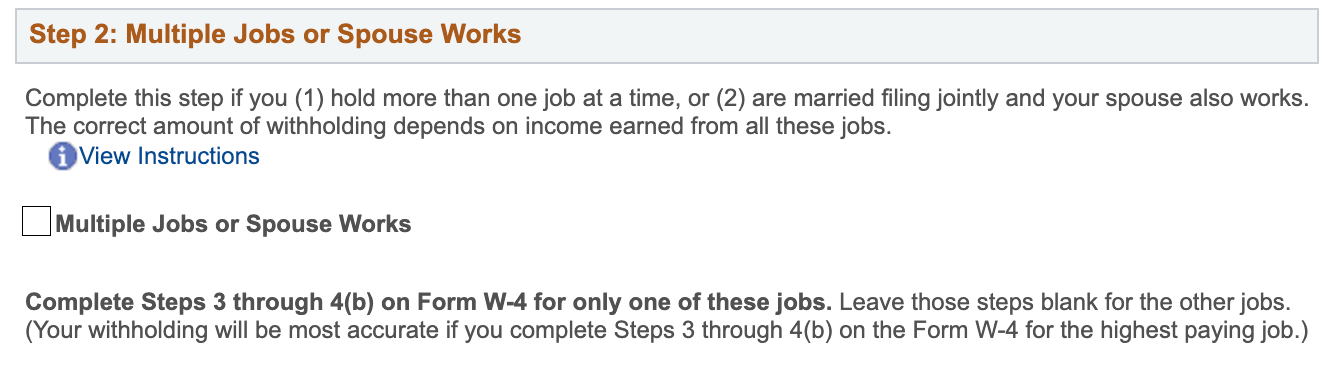

Tax Information

Federal Tax Witholding Rates

The federal withholding allowance amount is $4,300. You can use the Paycheck Calculator from paycheckcity.com to estimate your withholding. Using the federal withholding tax base (FWTB) determined in the paycheck calculator table, compute the federal withholding tax from one of the following tables.

Click here to view the current federal withholding tax tables.

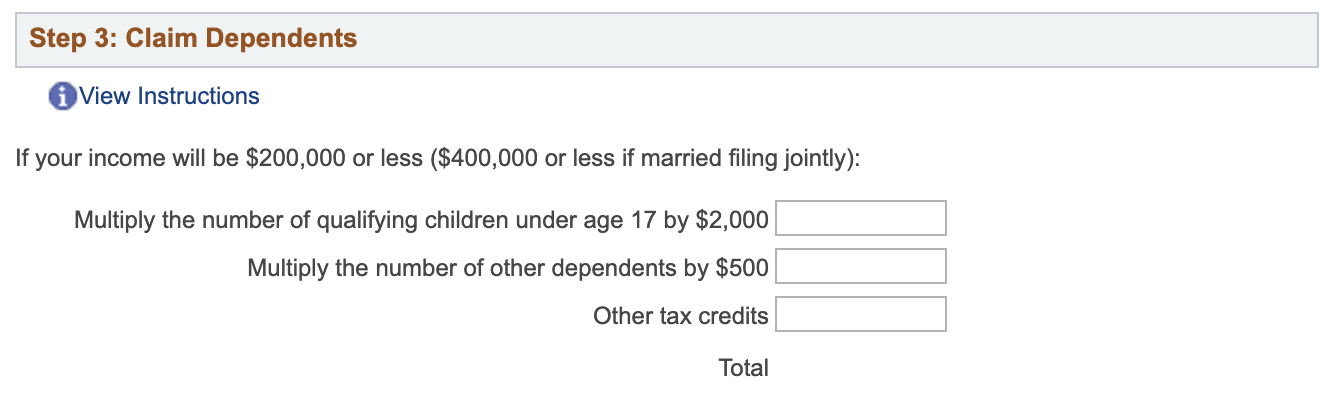

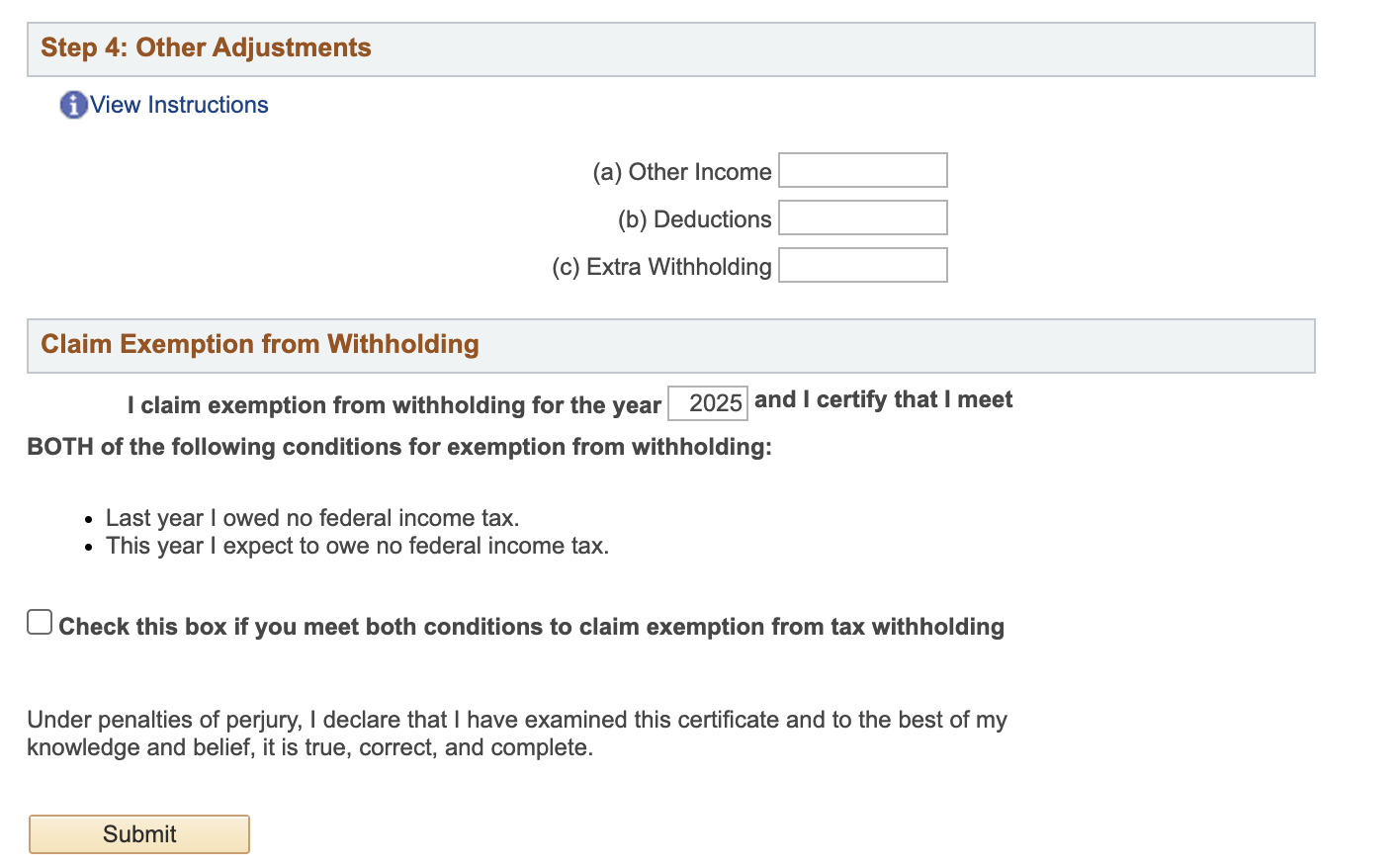

Click here to estimate how to complete Form W-4 so you don't have too much or too little federal income tax withheld.

Tax Shelter amounts include TSA retirement (Board of Regents Retirement Plan),KPERS deduction, voluntary TSA contribution, Kansas deferred compensation deduction, employee premiums for non-taxable group health insurance, KanElect flexible spending account deductions, and pre-tax parking.

Kansas Income Tax Rates and Examples

State of Kansas withholding tax rates will be used for all paychecks dated July 1, 2017 and later. The Kansas withholding allowance amount is $2,250.00.

You can use the Paycheck Calculator from paycheckcity.com to estimate your withholding, or Kansas withholding tax is computed as follows:

State of Kansas Withholding Tax Rates (Single or Married)

State of Kansas Withholding Tax Tables (Single or Married)